Work

Co-Founder @ Colorset

2022 → 202_At Colorset, we set out to modernize the commercial lending experience. The current process is highly manual, time consuming, and subjective. Decisioning on a loan can take 90 days. This often leaves SMB and SME business sitting on invoices with paid on net 90 or net 180 without cashflow.

Non-bank lenders now originate majority of loans at lower middle market and below. However, much of the LOS and LMS solutions are still targeted at the fraction of the market for large banks and lenders. With this growing pool, we aim to leverage alternative data to speed up the lending process and help these lenders focus on their customers.

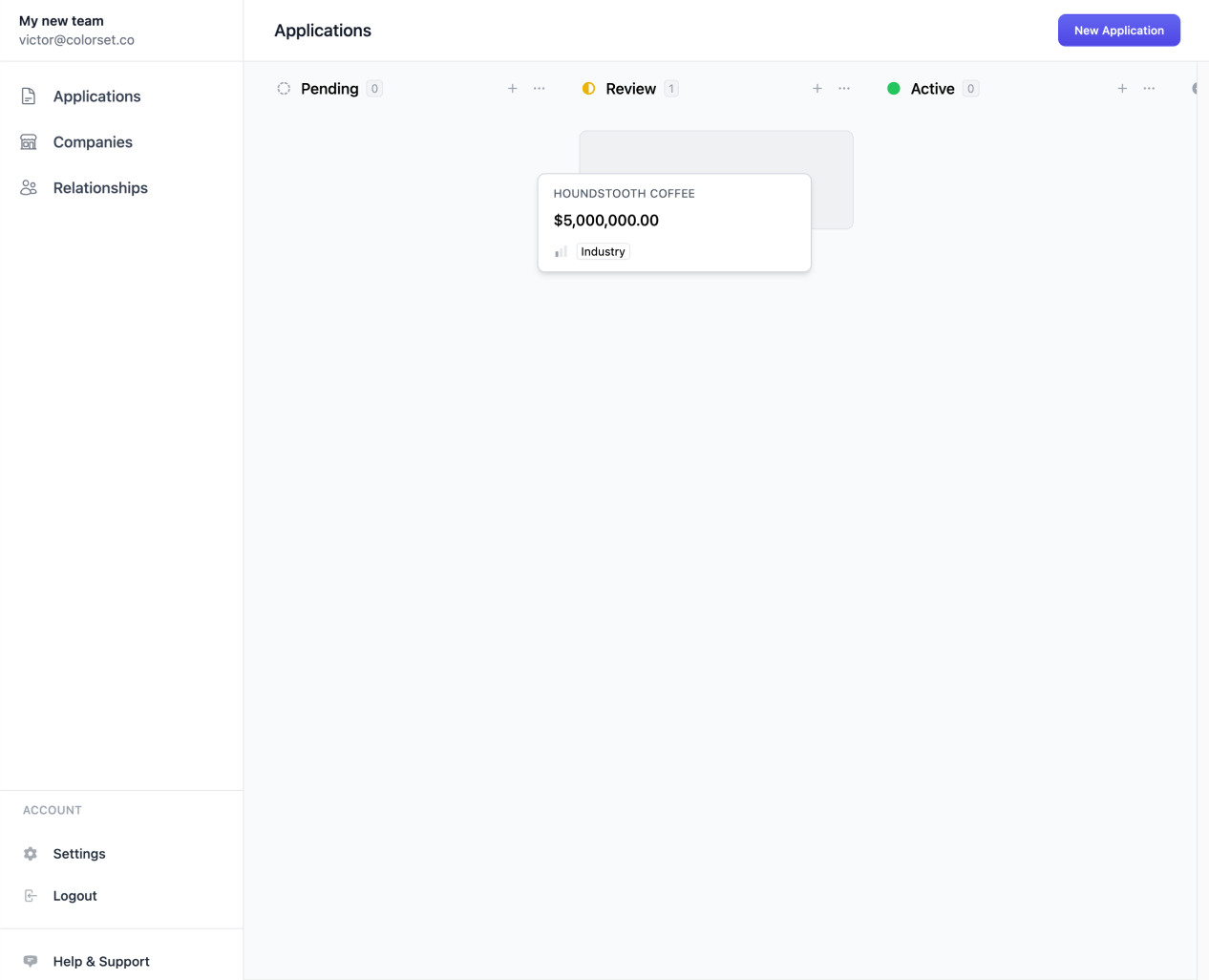

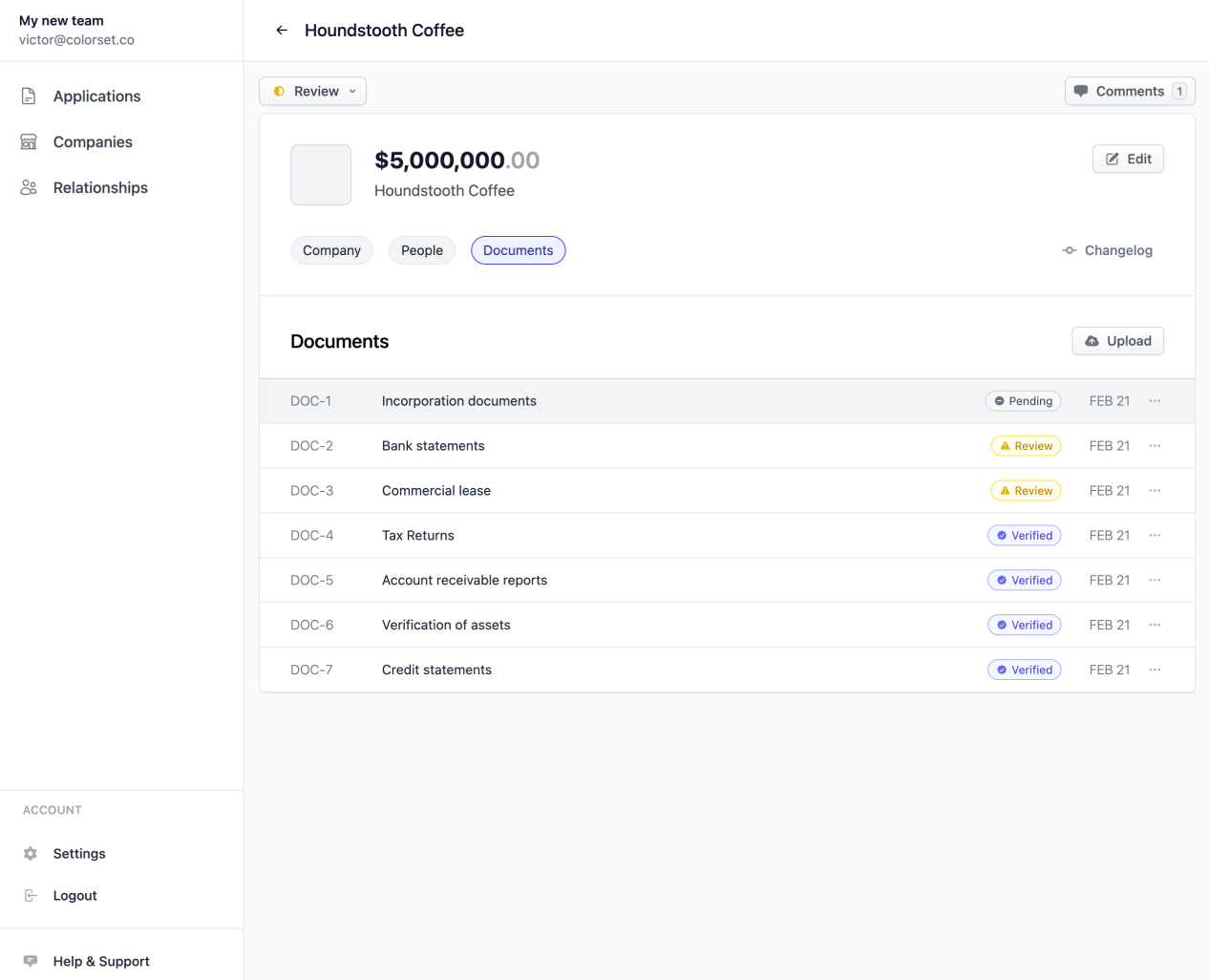

Colorset Applications view

Colorset Applications view

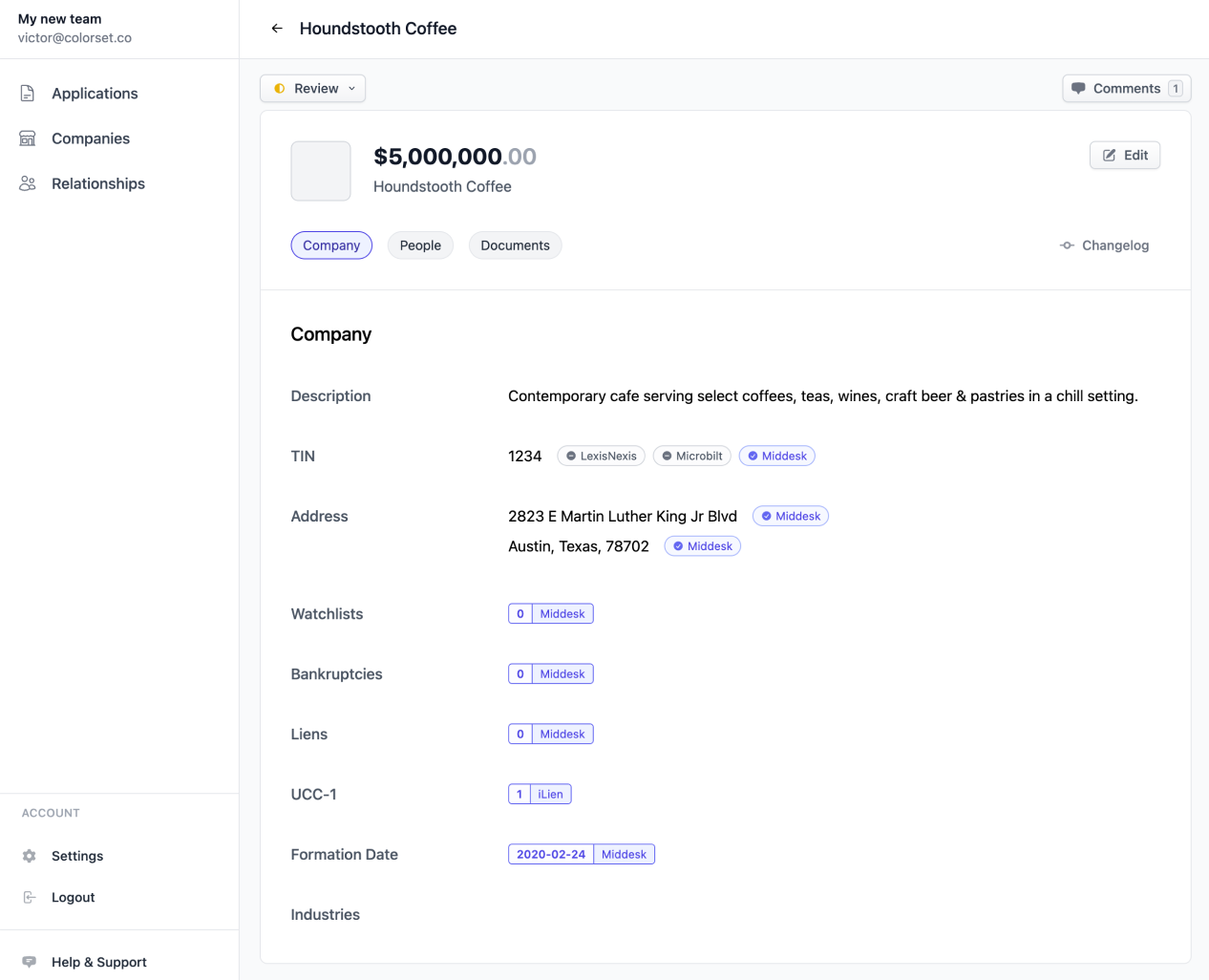

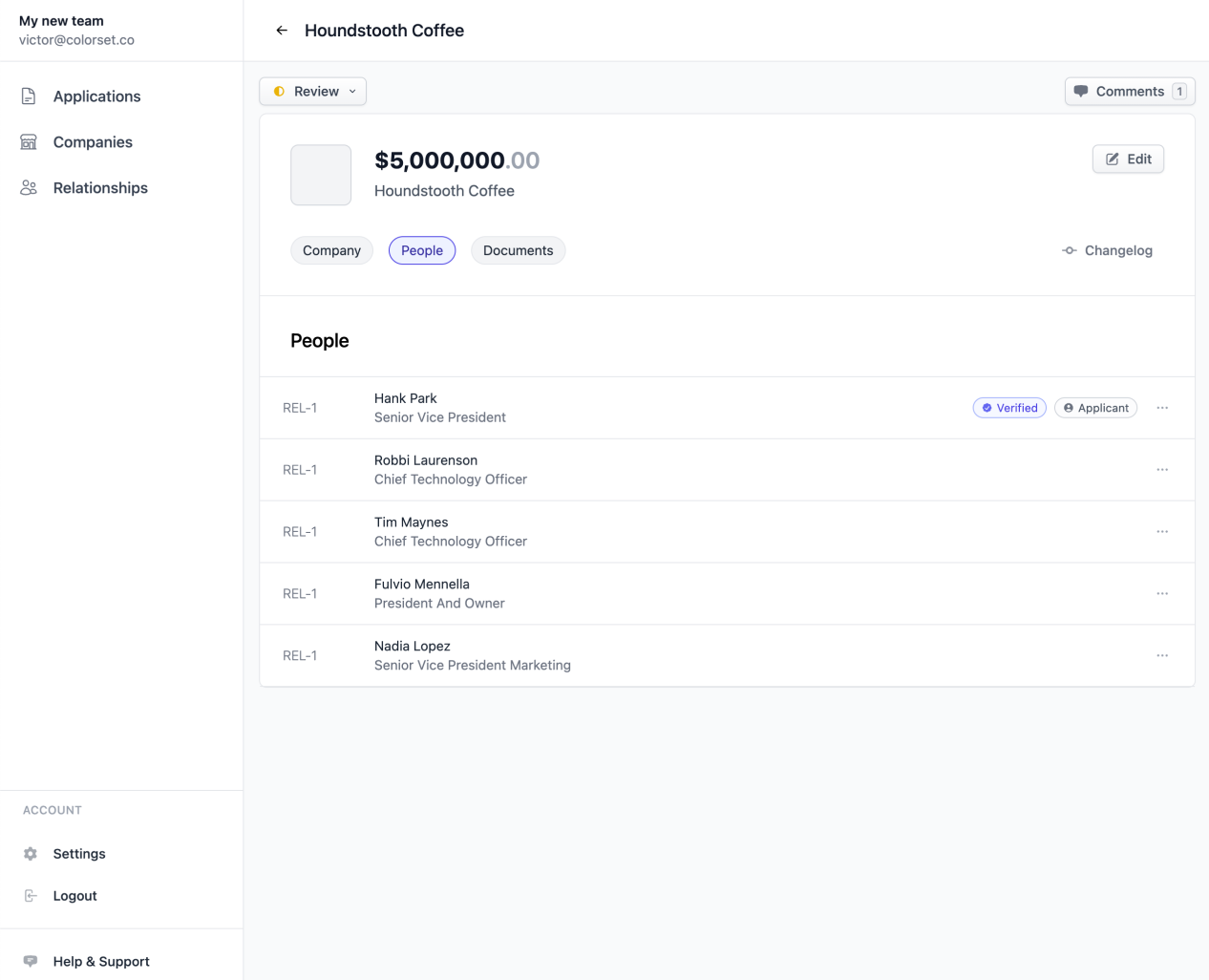

Often times lenders are tracking multiple loans, and need to pull data from various sources. But, unlike consumer lending, commercial lenders need more fine grain insight over companies.

We also track all of the changes to a report and link all of the information back to the documents gathered from the applicant.

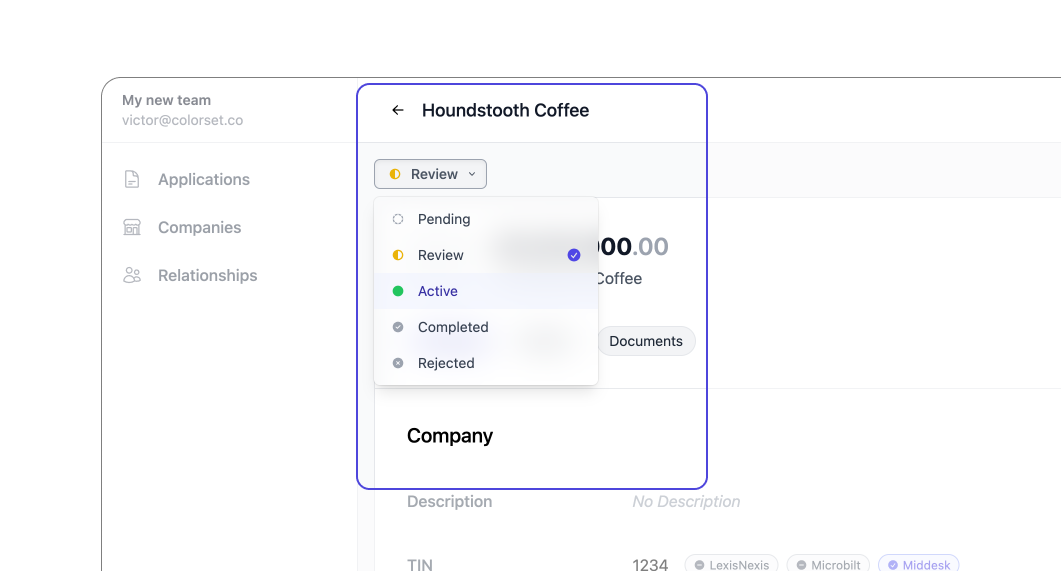

Colorset also manages the of an application state it has been actioned on, and assigned to operations to handle for servicing.

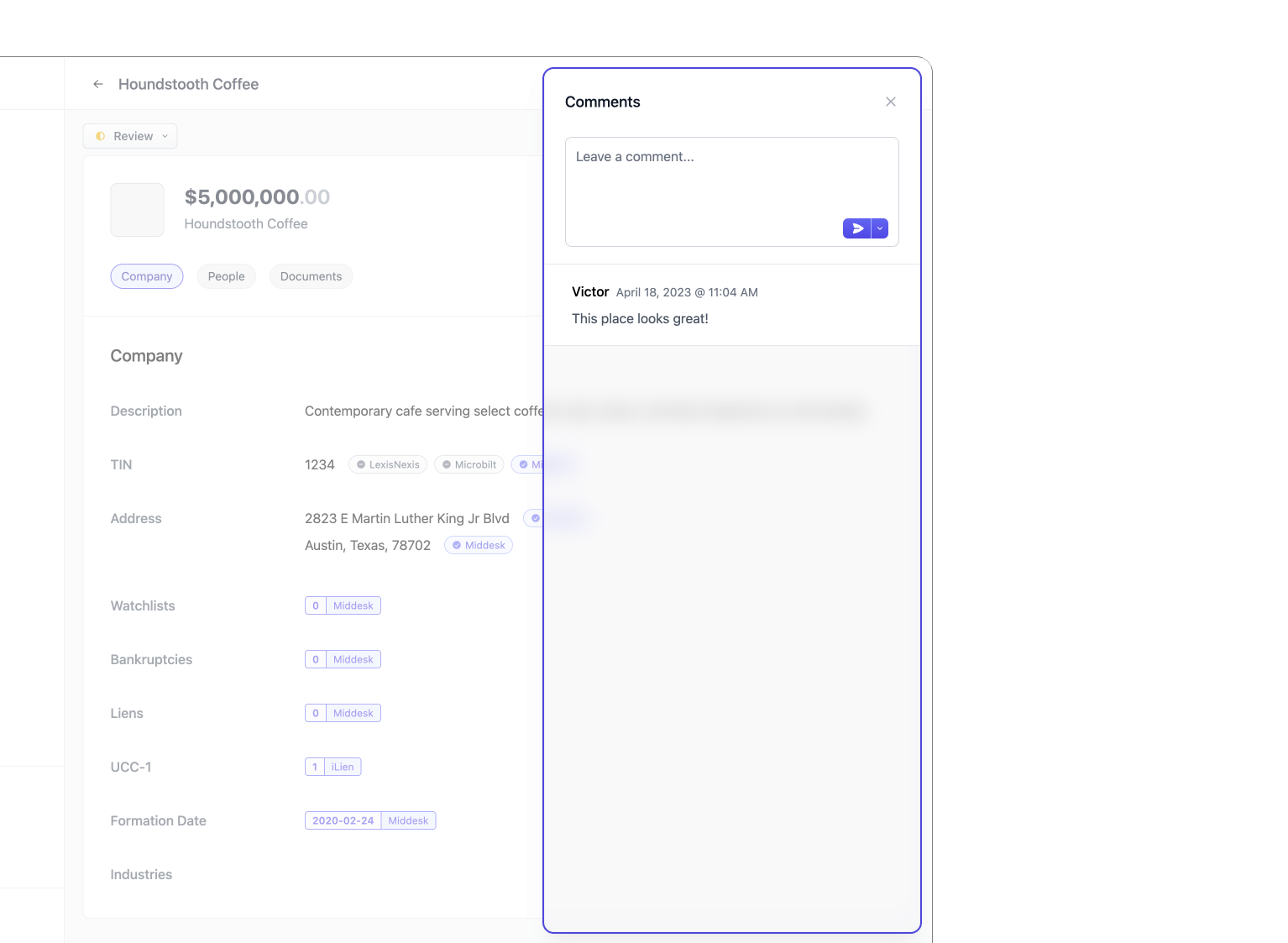

To help keep the entire team from sales to servicing on the same page, all the context and comments are collected on the application.